The limited offer of (inclusive) impact investment products steers investors towards different(iated) impact levels, preferred investment products & impact assets allocation.

E.g. in fixed income green or muni bonds, health (property), farmland REITs, sustainable real estate or SDG investment funds.

Of course all investments have impact, but impact investing aims at doing well & doing good, which in today's investment market varies from doing less harm (the largest offer in investment products) to having positive: broad and/or deep impact. It is a developing universe with growing impact transparency & increasing product innovation.

Overwhelmed by the choices, discourse & reasoning in the impact investment universe?

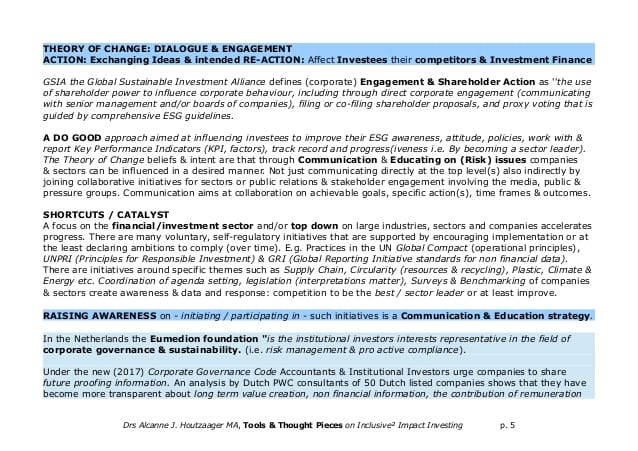

Just as their financial strategy or mandate defines the risk appropriate return goals, defining a Theory of Change is a strategy for impact investors to define how to achieve impact: societal & environmental goals.

I will sketch impact investment choices based on i.e. actual market offerings & trends such as Exclusion, Engagement, ESG Integration and more impact ambitious goals such as SDG contribution as Theories of Change. Ethical, ideological or sustainability motivations will improve investors understanding of impact dilemma's & choices.

THEORIES OF CHANGE are like INVESTMENT MANDATES: guiding principles to achieve the impact goals.'Balancing impact & return' mandates -the preferred strategy for large impact investors (theGIIN Global Annual Surveys) can be exclusion guidelines and/or allocation to low(er) ESG (Environment, Social & Governance) Risk Exposure and / or Selection of ESG Opportunities, Best-in-Class investments and SDG & (Deep) Impact Investments.

Overlapping of ESG & IRD = WIN WIN

ESG Environment, Social & Governance activities

&

IRD: Innovation, Research & Development investments.

Using less natural resources such as commodities/extractives, energy, (sweet) water requires Innovations ie Research & Development in production processes lower production & societal costs. E.g. discovering or developing alternative resources, more efficient production and re/upcycling & waste management.

Tech Optimist or Tech Dystopian?

Human Resources i.e. PEOPLE, Labor are indispensable to develop & steer (Tech4Good) Automation & Robotisation to ease hard labor and assure global access to Basic Needs.

In Human Resources & Marketing ageing in developing markets, population growth & the call for inclusive economies offering Income, Employment & (Global) Access to Basic Needs such as Security & Shelter, Food & Clean Water, Healthcare, Education, Opportunities (Hope) & a Livable Planet demand corporations reinventing themselves.

Corporations i.e. Capitalism choosing Impact Growth Strategies: focus IRD investments towards impact services & products are attractive investments.

Their MOAT (long term economic perspective) is WIDE as successful companies will be the multinationals of the future providing economic growth/innovation, employment & socialtal solutions: impact services & products.

#TheTimestheyareChanging: ''Even America’s famously ruthless bosses agree. This week more than 180 of them, including the chiefs of Walmart and JPMorgan Chase, overturned three decades of orthodoxy to pledge that their firms’ purpose was no longer to serve their owners alone, but customers, staff, suppliers and communities, too.'' @TheEconomist 22aug1029

Want to read ahead?

Go to https://www.slideshare.net/alcanne/impact-investing-theories-of-change-145289451 page 9