SUMMARY

The

G7 Social Investment Taskforce recently appealed for a 'kitemarking

label' for (social) impact investments in her final report. But why

a mere label? Important is how much!

Is

an impact indicator for investment products feasible, as in both

possible and practical, that would give investors an idea of the

impact of their investment at a glance? And that gives marketeers an

interesting instrument

to

attract lots of cheap(er) capital?

The

author thinks is it. But only when mainstream systems for Socially

Responsible Investment and equity selection criteria on Environment,

Social and Governance (ESG) policies -doing less harm- team up with

ESG opportunities and impact investing. The latter investment

selection strategy aims at 'doing good' at peoples basic needs level

and catalytic fields working on global challenges.

The

implementation can be a carbon copy of the recently developed system

for standardization and (external) verification of green bonds.

A bonus is that is also works as an impact investing market accelerator.

CONTENT

Acknowledgements

Further

research

Diverging

or Converging? The civilization process of impact investment and

Do

we need a Jerusalem Council for sustainable and impact investing?

Introduction

What

an impact indicator could indicate

What

an impact indicator would be based on

Ask

and thou shalt receive

The

Sonen Capital KL Felicitas Foundation methodology for sustainable &

thematic investing with asset class based returns.

An

impact indicator model

Comments

and recommendations:

Harry

Hummels: Is it true? Is it expensive?

External

verification and leveling impact

Frank

Wagemans VBDO

5

levels proposal

A

clarification of the Impact indicator levels

Levels

0-6

When

does an investment product fit the level?

Flexible

or Precise

A

peaking impact investment universe?

No, a terraced pyramid

Opening up the investment market

The impact indicator as an accelerator

Opening up the investment market

The impact indicator as an accelerator

Feasibility of the

impact indicator for investment products

An Implementation path

An accelerator for the

Impact investment market

Acknowledgments

I

want to thank Prof Jed Emerson,

who coined @blendedvalue

and publishd a dozen Issue Briefs for Impact Assets. He

suggested that I write a clarifying article on the impact indicator

model for investment products. It asks for an explanation off the

different levels and their distinctions which of course in practice

will encounter some difficulty. Which is why the barometer model is

useful.

Especially

Jed's emphasis on the correlation between risk and return is vitally

important to stress that high impact levels however say nothing about

returns.

For

the impact indicator it turns out to be important to stress that high

impact levels say nothing about returns. The traditional perception

of the costs of responsible investing are applied to impact

investing

as well. Partly because of the pioneering area of impact

first investing.

When return was redeemed for impact. But in earlier drafts of the

indicator balancing return and impact to me was so obvious I did not stress

it explicitly. But it it

turned out to be important.

Harvard academic showed in 2011 that best

in class investment strategies actually

give better returns going back 20 years.

Thanks

go to Prof Harry Hummels, University of Maastricht,

Actiam IIAM, theGIIN and UNPRI thematic investments who asked about

verification and the costs of impact indicating. He inspired me to

write the paragraphs on implementation which are actually a carbon

copy of the highly successful climate bonds standardization and

verification system that has been built over the last last few years.

Drs

Frank Wagemans of the VBDO, (the Dutch) Association for

Investing in Sustainable Development looked at the model as well and

suggested a simplification of the levels which is always a good

idea. But in this case I chose to keep the differentiation to

avoid having sustainable investment products in sectors that deliver

no or little impact to society at large. One of most surprising

revelations I had once I got interested in impact investing

was when I realized mainstream sustainable investing is mainly about

doing less harm and exlusion strategies and hardly

about doing good investing with intended positive impact.

And a special thanks to Dr Kellie Liket who inspired me with her thesis 'Why 'doing good' is not good enough'' Essays on Social Impact Measurement 1*. Bust mostly by repeating the question how do you measure you impact? First I came up with an appeal for impact indicator in Impact Investing Nieuws 1juni15 2 followed the draft I will clarify in this article. The impact indicator doesn't give the detailed impact indication that she would like to see. It is not a sophisticated quants (data) of qualits (holistic) impact measurement system. But it does give an indication of impact at investment product and portfolio level. And suits the practice of investing where diversification by spreading risk is part of a sensible strategy.

*Footnotes at the bottom of the page

Further research

Further research

As

with any thought piece, further research ideas develop once you

start. I am thinking of a piece on converging and/or diverging

of impact and mainstream investing. A civilization

process of investment in

the spirit of Norbert Elias classic theory described in

the Civilization process. Converging forces are powerful, thanks to

hard work of theGIIN, the Global Impact Investing Network and

involved major players such as the recent publication linking it's

Impact Reporting Investment Standards (IRIS) to the Global

Reporting Initiative (GRI) 1.

The

case for an impact indicator for retail investment products

The

G7 Social Investment Taskforce just appealed for a ''kite

marking label''

for social impact investments in their final report (Sept. 2014) 2.

But

why a(n other) label? Naming something ''impact'' could be as

sufficient and (in)effective as Socially Responsible, Ethical, Social

Impact Bond, Green or Climate Bond labels are.

An

impact label without loading it with impact insight, to me seems mere

'advertising'. Maybe this is a Dutch cynic speaking, as Dutch

consumers are overwhelmed by labels communicating -but not very

effectively- healthy products, environmentally or animal friendly

products, quality certificates etc. A mere label to me seems to

underestimate

the intention, ambition and understanding of (potential) impact

investors and the impact

investing

market.

Why

not give investors an indication of the impact of investment products

to be reviewed at a glance? To give investors insight in the

non-financial returns of their investment, the impact of their investment.

More detailed impact

measurement system information can be presented in the impact

paragraphs of the prospectus.

What

an impact indicator could indicate

An

impact indicator

would not focus on impact risk, as risk is directly related to

return, the risk appetite of an investor and their portfolio

allocation. Aiming for more or less impact has risks just as aiming

for financial return does. For instance: the

risk of poor impact results

or even was

the intended impact achieved at all?

Nor would the impact indicator embody impact costs and cost

effectiveness, the choice of impact assessment methods, use of

technical assistance, co-operation and lobbying etc. These are part

of the business strategy and model and could be part of an adjoining

prospectus.

What

an impact indicator would be based on

The

impact indicator I envision would focus on investment in impact

sectors such as:

-1-

Basic need sectors: such as work & income, healthy

nutritious food, clean sweet water, hygiene and sanitation,

affordable health care, affordable education and affordable lifelong

job (re)training and last but not least affordable safe green housing

to come home to in a safe area. That requires community care and

development and what about our global home? So I am adding

biodiversity and environmental protection;

-2-

It would have a

global outlook. Although

differences in needs and available affordable solutions are enormous,

mega trends such as growing demand due to population and economic

growth point out that especially where it comes to fulfilling basic

needs, humanity has the same agenda.

-3-

It has to include Impact catalyst sectors: such as financial

inclusion (micro insurance, -mortgages, -insurance etc. Giving

families security and support when disaster strikes. Clean, green and

renewable energy and technology and IT. Think IT as in opening up

'information deserts' or worse ínformation monopolies' through

access to the Internet and mobile phone connecting peoples and

markets. Or sophisticated smart data analyses, helping businesses and

consumers to make better use of resources;

-4-

It would incorporate

existing rating systems,

but not so much the rapidly developing impact metrics. But mainstream

investment rating with track records and benchmarks. Think

sustainable indices, Environment, Social, Governance (ESG) and

Corporate Social Responsibility (CSR) ratings. The latter may be

getting a bit out of fashion, but it has (had) a positive influence

on resource management, labor conditions, local production sites and

philanthropic activities. CSR and these days the more popular ESG

integration in portfolio management, has been proven financially

successful. Especially for best-in-class

sustainable companies

3.

-5-

And last but not least

the scaling potential

is included in a long term perspective. The growth strategy,

financing structures and shareholders are aligned to get part of the

returns re-invested

in the impact activities. Multinationals save millions by investing

in health & safety, cutting energy, water and resource expenses

and re-invests in next phase steps in these field and/or (promising)

impact activities for there core activities 4.

Re-investing

can be done through rolling out impact activities or in the long run

through Research & Development, corporate venturing, (investment)

partnerships and through financially innovative structures such as

Socially

Responsible Equity

ensuring re-investing in impact as defined by Alex Hamilton Chan.5

Ask

and thou shalt receive

Within

a week

after

pleading for an impact indicator on Impact-Investing-Nieuws

Sonen

Capital

sent me their asset management report for the KL

Felicitas Foundation:

2013

Annual Impact Report, Impact Investing in Public Markets:

Methodology, Analysis and Thought Leadership.

(pdf, 60 pages). Sonen

Capital

was founded in 2011, specializing in impact investment for investors

aiming to achieve financial-, social- and environmental return with

public

equity fixed income

investments. In

2013 it

developed a portfolio impact measurement method: Evolution

of an Impact Portfolio: From Implementation

to

Results

(pdf,

70 pages) with support of the KL

Felicitas Foundation (KLFF).

This portfolio model was presented in a report for the World Economic

Forum 2014 6.

The

KL Felicitas Foundation

(KLFF) with it's 10 million US$ assets may be a relatively small

foundation compared to some of the impact

investing

giants such as the Rockefeller

and the Bill&Melinda

Gates foundation.

But it is a pioneer in public

equity impact investing

with a ten year track record. Guided by big bucks snobbery I never

looked into their approach before, even though I came across them in

one of the first publications on impact

investing I read:

Solutions for

impact investors: From strategy to implementation 7

(2009)

by

Rockpa, the

Rockefeller Philanthropy

Advisors Raul

Pomares and Steve Godeke. These days Raul Pomares is director at

Sonen

Capital.

From

2004 onwards the KLFF

searched

for the best way 'to

build

an

investment portfolio that would align with their values and the

Foundation’s purpose, while also ensuring KLFF’s ability

to meet its financial obligations.

It's

mission is: to

enable social entrepreneurs and enterprises worldwide to develop and

grow sustainability, with an emphasis on rural communities and

families. The Foundation also actively advocates it's Impact

Investing strategy” 8.

In

its impact investment strategy Sonen

Capital

distinguishes between

sustainable

investors

that aim for do no

(or less) harm by

limiting the consumption of energy, water, resources and limiting

harmful emissions; and thematic

investors

that

aim for do

good

by investing in environment and/or social themes. According to them

defined by the United Nations sustainable development catalysts:

Employment,

Clean energy, Sustainable cities (urbanization), Food security and

Sustainable agriculture, Waste management, Disaster resilience and

Oceans.

In it's asset allocation strategy Sonen

Capital

uses traditional asset classes system:

fixed income, equity, realty

etc. Results are presented as returns and impact performance.

Looking at their

portfolio allocation strategy and integrating the

tradition and ambition of private equity impact (first) investing

this is what I propose:

a barometer with

increased impact giving special attention to what impact investing

is all about developing and upscaling solutions for global basic

needs challenges. The barometer design is a copy of the European

Union's Risk(baro)meter to give investors insight in the risk of

investment products.

The

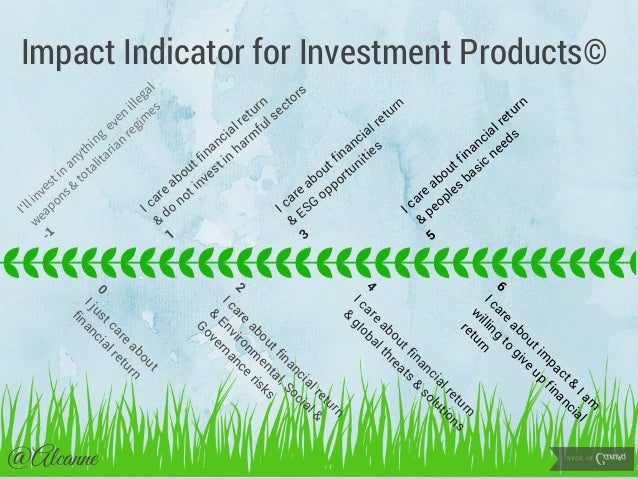

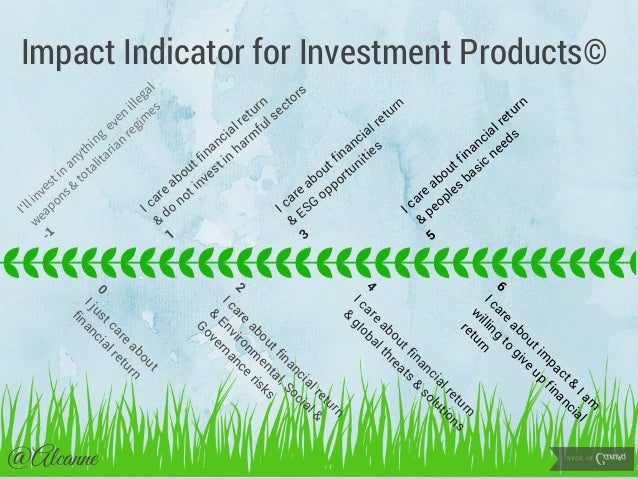

Impact indicator

0

= I just care about financial returns;

1 = I care about financial returns and will not invest in harmful industries and products;

1 = I care about financial returns and will not invest in harmful industries and products;

2 = I care about financial returns and

Environment, Social & Governance risks;

3 = I care about

financial returns and Environment, Social & Governance

opportunities;

4 = I care about financial returns and

global threats and solutions;

5 = I care about financial

returns and peoples basic needs;

6 = I want to invest in

impact and I am willing to give up return without giving up scaling

potential.

(Formally there could be -1 = I'll invest in anything:

even illegal weapon builders, totalitarian

regimes etc thus breaking international laws). That should

discourage investors and thus will

hardly be applied unless the regulators take a stand.

Note

that half of the largest impact investors surveyed by theGIIN and JP

Morgan Social Finance state they manage to balance impact and return. Some

value impact over return (impact first or catalytic impact investors

investing in 'stars', future income earners for sectors or regions)

and some value return over impact (finance first) GIIN

JP Morgan Perspectives on Progress 2014.

Comments

and recommendations

I sent out the first

draft of the indicator model with the original appeal to Prof Harry

Hummels and Frank Wagemans the Dutch Association for Sustainable Development and

asked for their comments.

With

Prof

Harry Hummels The

Netherlands has an ardent champion for impact

investing,

he is even nicknamed Mr

Impact Investing.

He teaches at Maastricht University and previously at Nijenrode

Business University. He set up sustainable investing at ING (Paribas)

Bank in the Netherlands, which by the way just became diversified

financials

sector leader in the Dow Jones Sustainability Index. In 2007 he

surveyed the largest Dutch charities on their asset management,

sustainability and mission related investing. In 2009 he developed

the responsible asset management guideline for the Dutch Charity

organization VFI which represents the 100 larger fund raising

charities

9.

In 2011 he started Impact Investment asset management at SNS Bank

(recently renamed Actiam)

and in 2013 he became European liaison for the Global Impact

Investment Network (theGIIN). It is no coincidence that the GIIN has

an impressive Dutch participation 10.

I

am very happy he took the time to look at my impact indicator and

will go into his comments on verification

first.

He characterizes it as a independent impact ranking system for impact

investment marketing purposes.

As

far as I know nobody came up an instrument like this before. Maybe

the French Finansol

label for responsible investment products shares some

characteristics. Note that the French Responsible or Sustainable

investment market is quite advanced and France is European market

leader in best-in-class

public equity investment. (Eurosif 2012) NAB

France 11.

Is

it true?

Prof.

Hummels points out that as a marketing tool, it's success will come

from sincerely applying the different scales system and/or from

external

sources. Verification

would build consumer confidence, but would also be introduced at a

price.

Business for accountants and consultants...

Sectoral

cooperation for consumer information

But

I would prefer it if banks, asset managers and impact and

sustainability experts cooperate and agree to impact indicator

principles. In the same way ten major banks defined the Green

Bond Principles to make sure that what the market offers

and what they are to underwrite and distribute lives up to

expectations and standards 12.

An

external

organization

such as the Climate Bonds Initiative (CBI) can be invited to provide

the necessary sectoral guidelines with sectoral experts from

(investment) business, governments, NGO's, academia and other

relevant fields. As they are doing right now at amazing speed to

assure quality green bonds standards for property, transport and

mobility etc. And recently for water and sustainable agriculture

impact sectors! 13.

An

other interesting feature of the CBI is that they invite and approve

external verifiers. It promotes climate bonds actively and monitors

and researches market developments. Recently it published a report on

the state of the Green Bond markets 2012-2013 at the request of HSBC

14.It

is sponsored by major international banks, the European Climate

Foundation and the Sainsbury

Trust

and partners with many other major banks.

Leveling

impact

Harry

Hummels also points at the complications of prioritizing basic needs

(sectors) over world wide threats and global threats and these over

ESG opportunities. And defining the distinguishing barriers. A tricky

aspect and indeed complicated to apply in the present investment

market. Frank Wagemans of the Dutch Association of Investors for

Sustainable Development (VBDO) appreciated the gradual design, but

suggested a simplification of the model by deleting 2 levels as level

4,5, and 6 are not levering impact from their perspective.

First

a bit more on the VBDO: it was founded in 1995 and started asking

critical questions at stakeholders meetings. It has an unusual

structure with thousands of small private sustainable investors and

dozens of larger institutional investment managers, banks, asset

managers and advisory firms 15.

It's

focus is on promoting sustainable business practice in companies,

sectors and supply chains. It thus undertakes many sustainability

benchmarks in the Netherlands and is very active (and successful as

active shareholder

(engagement,

dialog and voting)

co-operating with corporations. It is also introducing new

sustainability themes in the financial arena such as tax paying by

multinationals.

I

feel his proposal reflects the VBDO operational strategy and

approach. It considers 'impact investment a specific form of

sustainable investing' as opposed to my sustainable investing 2.0.

Please note the VBDO comments are translated by me.

Frank

suggests leaving the lower levels as they are, but adapts the higher

levels adding sustainability policies and dialog 16:

Level

0: I just care about financial returns;

Level 1: I do not invest in harmful industries and products;

Level 2: This investment product uses ESG data for better financial assessment;

Level 1: I do not invest in harmful industries and products;

Level 2: This investment product uses ESG data for better financial assessment;

Level

3: This investment product uses dialog influence sustainability

policies and practices;

Level

4: This investment product selects corporations/activities that

support and successfully practice sustainability policies (a positive

selection approach);

Level

5: This

investment product measures and selects projects/corporations on the

merit of positive impact on society and aims at enlarging it's

impact.

Grading

on sustainable business practice

In

theory this leveling system makes perfect sense. The paradox that

arises is that companies can move up to high impact levels on the

basis of their ESG and sustainability policies, dialog with

stakeholders, reporting and progress. Which gets them noticed by

RobecoSAM and in Dow Jones Sustainability

Index. But that does not make

their core business sustainable. That can be (soft)drinks, snacks and

processed foods that nutritionists and medical staff are hesitant off

and recommend sparse consumption. Or they can be fossil fuel

producers with sustainable business practices that are not seriously

investing in the transition to renewable energy. That it is a dead

end road with accumulating negative side effects. It is with this

amazement that I look at the Dow Jones Sustainability Index

and some of it's super sectors and leaders. They may have sustainable

business practices, but that does not make their core business

sustainable...

The

paradox of the impact indicator model is that it values

qualitative impact over quantitative impact. For example a smal scale

activity such as a Social Impact Bond or Wakawaka solar lights that

provide free healthy safe lightning at night. They get a high impact

score and for instance than large scale energy savings by

multinationals. Or the Dutch beer brewery Heineken which is

considered not sustainable because it produces alcoholic beverages,

but it is also champion water savings. And because of it size that

means a lot of sweet water is saved.

So

what's the paradox? The large size of the savings seems to mean more

that a small scale innovative impact investment. But traditional

markets and consumption patterns are growing which means the gap

between the 'haves' and 'have nots' is growing too. And

when it comes to nature and resources they keep using, exhausting and

in the worst case wear out completely. And this is where impact

investing wants to offer an alternative. Meeting basic needs for

a lot more people and accelerating the transition to less

consumption, pollution and destruction. This can be achieved through

(radical) efficiency and using less harmful resources, but also by

investing is less harmful ways of production.

A

clarification of the Impact indicator levels

I

will clarify the impact indicator levels in more detail, thus hoping

this will remove some of Harry's and Franks doubts.

Level

0:

'I

just care about financial returns'

is the mainstream investment market or almost 90% of the financial

markets in the US according to the Sustainable and Responsible

Investment Forum (USSIF). According to very recent data in (Western) Europe it is almost 60%,

down from 90! is not SRI managed assets according

to Eurosif 17.

Level 1:

'I do not invest in harmful

industries and products' is

a reflection of exclusion

strategies.

Exclusion to be in compliance

with international regulation on cluster and

land mines, chemical weapons, nuclear weapons and weaponry unable to

distinguish between military, terrorists and civilians. But also

Norm-based or Ethical investment

which embody mainstream SRI or sustainable investment funds excluding

corporations active in the field of AGTAF:

Alcohol, Gambling, Tobacco, Adult Entertainment and Firearms. Next to

that the broader 'Western-Judeo-Christian'

exclusions horizon of corporation

associated with nuclear energy, pornography, fur and factory farming

(of animals), test animals, lack of supply chain management ...18.

There

are also

Halal or Sharia investment

exclusions based on Islamic beliefs. They are

comparable to AGTAF exclusions with an interesting addition. They

focus on no interest payment and avoiding gambling practices includes

investing in options, futures and day trading. From the point of view

that Impact Investing

is long term investing providing 'patient

capital' this approach of Sharia Investment

fits impact investing

very well 19.

There might be

investment strategies based on Buddhism, Hinduism or other world

religions but I did not come across then yet.

Addition: Ann Logue describes them in Socially Responsible Investing for Dummies (Keeping the faith: Investing with religious beliefs) offering little guidance. The fact that the Dow Jones Dhama indexes, launched in 2008 embracing Bhuddist, Hindu, Jain and Sikh principles has disappeared probably says more.

Addition: Ann Logue describes them in Socially Responsible Investing for Dummies (Keeping the faith: Investing with religious beliefs) offering little guidance. The fact that the Dow Jones Dhama indexes, launched in 2008 embracing Bhuddist, Hindu, Jain and Sikh principles has disappeared probably says more.

Level 2:

'I care about financial returns and Environment, Social &

Governance risks'. This reflects a major existing

strategy excluding corporations that pose these risks. Such risks

reflect high(er) production costs such

as costs due to the (lack of) labor safety (compensation and sick

leave) and high turnover (lack of diversity) or companies whose

activities rely heavily on (intensive) use of (fossil) energy,

(sweet/clean) water and rare or scarce resources. If they do not

develop efficiency programmes,

alternatives, recycling and or climate change policies their products

will become either too expensive or even impossible to make. ESG risk

corporations also face penalties and fines

for breaking (inter) national laws and regulations and reputation

risk and business-to-business and/or consumers boycotts.

Think: human rights violations, use of child labor, disrespect of

labor and political rights, discrimination, corruption, lack of

environmental and or biodiversity protection.

This is an existing

category in socially responsible or sustainable investment served by

the ESG research sector which offers data on individual corporations,

but also sectoral databases with information from internal and

external sources on a variety of ESG risks.

Level

3:

''I

care about about financial returns and Environment, Social &

Governance opportunities''.

This level represents corporations that focus on

ESG opportunities that directly aim their business process, products

and activities. Think Sustainable investment funds marketing

themselves as aiming to invest in sustainable ''pioneers'' with

various ambitions (Triodos

Sustainable Pioneer,

KDB KDB

SRI Pioneer Asia,

GIIRS/pioneers).

One

Dutch Bank is completely transparent about it investment universe on

sustainability criteria and regularly updates it. It is Triodos bank

and you can find it's investment universe of hundreds of stock listed

companies on-line 20.

It

does not claim their list is complete or that if a company is absent

it does not meet their strict investment criteria. Because it is

neither

feasible nor desirable to investigate all stock listed companies.

Note

that they do not claim that these companies pose ESG opportunities

but it is my sincere impression that due to their criteria and

assessment the companies qualify as ESG opportunities. And thus their

universe at

least

adheres to level 3 and probably higher as well.

Sometimes

ESG Research firms open up about their assessment of ESG

opportunities, beyond the data that is offered to their paying

clients. Sustainalytics,

awarded twice as best ESG researcher by it competitors, published '10

Companies to Watch in 2014'

in

January 2014 focusing on their

outlook for the next 12 months. It presented 8 ESG-risk

corporations

and 2 ESG-opportunity

corporations

the latter both in the food sector (impact: a basic need). They were

Dutch Corbion (previously CSM) and

US/Chinese Smithfield Food Inc and Shuanghui International Holdings

(mainly meat, so unfortunately with negative impact due tot the ratio

of vegetables needed to produce meat) 21. Unfortunately

in 2014 Corbion

has

done

very

poorly

on the stock market.

Note

that I do expect ESG-opportunity investment products developers to

exclude ESG-risk as well by pursuing sustainable business practices.

An investment in a low income country, for instance an internet

company in Africa, should adhere to ESG-standards 22.

By

now you are probably thinking: is it actually available?

Corporations

activities in this field will never be able to claim more than 50% of

the activities to be aimed here. But that doesn't mean it can not be

an investment opportunity. A corporation can offer a ESG-opportunity

bond as an investment product, just in the way corporate Green,

Climate, Social Impact and Developments Bonds have entered the bond

markets. And last year at such a speed that they overtook traditional

issuers such as international reconstruction and development banks

23.

Level

4:

I care about about financial

returns and global threats and solutions''

Since level 2 deals with ESG-risks and

level 3 with ESG-opportunities what differentiates level 4 from 2? A

broader horizon: so not just ESG-risks

and opportunities that deal with the company's activities and cost

enhancing factors and potential revenue 'stars',

but a more long term and wider perspective on global threats and

opportunities and where a company is heading. The

Economist's columnist

Schumpeter recently warned that this

kind of sustainability policies, the new green wave, might be costly.

But Schumpeter

failed to make the connection with green or impact investment and

it's cheaper capital advantage 24.

The

4th level is very much inspired by Terry Waghorn and Ken Blanchards

1996 book Mission

Possible

(McGraw Hill, available at Amazon) where they urge corporations to

not just focus on improving the present business processes and

models, but constantly think about the next decade and where the

corporation wants to be and what they want to be doing.

In

the Goodreads

summary it states:

'how

to improve their present organization while simultaneously creating

its replacement' 25.

Probably

it is more about being innovative,

than

socially responsible, but being an idealist I hope and pray for their

activities to have impact. These days Terry Waghorn is a contributor

to Forbes.com where he covers the intersection

of innovation and sustainability.

And he started a new

breed investment fund Veratak,

which is a spin off of the non profit award giving platform Katerva.

That used crowdsourcing

to find and evaluate innovative initiatives with up-scaling

potential. Veratak

focuses on agricultural technology, financial technology, clean

technology, life sciences, energy, water, and transportation.

It

is not just Terry's mindset, a Dutch asset manager focusing on

innovative companies also stresses long term commitments for broader

future strategies 26.

Planning

ten years ahead may seem ambitious in businesses with a quarter

earnings

reporting mindset. But especially for ESG and sustainability

ambitions it is a necessary time frame.

Management consultants McKinsey focused in their 4th

Quarterly 2014 on an article in Democracy:

A Journal of Ideas by two

of their alumni Eric

Beinhocker and Nick Hanauer. They stated

in their article 'Redefining

capitalism' that

modern capitalism and prosperity is about creating solutions for

societies challenges and making them available for all or at least as

many as possible 27.

Again,

this level of the impact indicator does not represent a league of

corporations or investment products that is easy to find. But

fundanalists, investor relations communication and PR departments do

share information about opportunities corporations are focusing on.

ESG research firms might share insights and/or define new themes and

public sources such as the Green Transition Scorecard on private

clean/green tech investment offer valuable data on sectors naming

corporations as well.

Impact

accelerators

It

is in this level that impact accelerators appear such as IT

solutions, smart data who are maybe not yet applicable in basic needs

sectors, but are becoming main suppliers of innovation and smart

green technology. I still put them in the lower level to stress that

an 'App' that teaches kids about nature preservation or makes

people aware of consumption (choices) has less direct impact than

products and services in the basic needs sector.

Level

5:

''I

care about about financial returns and peoples basic needs'' Impact

Investing

is and has always been about peoples basic needs: food, drink,

shelter, work and income, health care, education, inclusion etc. It

is the traditional Mazlov hierarchy of human needs focusing on

Physiological

needs

(food,

water, sleep),

Safety

needs

(Personal

and Financial

security, Health and well-being and a Safety net against accidents,

illness and their adverse

impacts),

Love

and belonging

and

Esteem and Self-actualization.

The latter are not easy to buy or invest in, but preserving and

promoting the environment, biodiversity and social-cultural heritage

come to mind 28.

In Mazlov's pyramid

description in Wikipedia I miss shelter and energy for heating and

cooked food that are essential in many parts of the worlds. But they

translate easily in healthy lightning and warmth sources preferably

without fire hazards, but renewable and not emitting smog, carbon

dioxide and greenhouse gases. Cultural impact investments could be

regarded as self-actualization (and in the Netherlands in the past

even had fiscal facilities).

Is

level 5 investible?

Yes!

(Impact) Investing in water, food, commodities, micro finance or

SME's (Small medium Sized Enterprises: the employment engine),

financial inclusion, social housing, care realty, regional or

(inter)national development, community development, social impact,

green bonds, clean tech, alternative energy, social enterprises is

already out there. And even better: to spread risk, there are

numerous sectoral ETP's (Exchange Traded Products) or

investment funds that often have major holdings in the market leaders

who often happen to be the sustainability and CRS leaders as well.

There

are investment products that are only available to institutional

investors or private equity investors, but there is no reason to

assume it will stay the latter's prerogative. Give them time to build

track records –and for the cynics to cream of the market- and

let them offer it publicly in a couple year's time. More Social

Enterprise IPO's (Initial

Public Offerings)

are also on the way. Or IPO's are marketed as impact investment.

Alibaba,

the Chinese web based business-to-business on-line marketplace, was

marketed as an impact investment in The

Economist

last year. It gives credit to SME (Small Medium Sized Enterprise)

companies active on their platform (based on their turnover insights)

29.

And

as SME's are an important income and employment accelerator, thus

Alibaba

became a SME financier.

Level

6:

'I want to invest in

impact & am willing to give up return without giving up scaling

potential'.

This

is another tribute to the origins of impact

investing

that for decades valued impact over return. The pioneer third world

investor Oikocredit now holds 800milion US$ under management and

doesn't pay more than 1,5% return.

The additional return is re-invested.

These

days impact first investing is often referred to as catalytic

impact investment

and it refers to building new impact investment area's. Opening up

new investment sectors and regions. Think the rolling out of micro

finance in financial inclusion (micro mortgage, micro insurance,

banking and mobile access...) Or investing in private and rural

health care, private education, etc. The Omydiar Network 30

is an excellent example of a catalytic impact investor aiming to open up new

investment sectors by building impact investment pipelines. It has

published a series of very interesting blogs about their strategy on

the Stanford Social Innovation Review website 31.

When

does an investment product fit the level?

Applying

the impact steps in my perspective allows for leniency as percentual

deviations are allowed, but as in promoting

the positive.

So an investment product can be scaled when at least half the

activities fit the impact level description.

This

is were my roots betray me, the Dutch are traditionally either

''rekkelijk''

(flexible, pragmatic) or

''precies''

(precise, as in dogmatic). It refers to a 17th

century conflict amongst Dutch Protestants resulting in the

excommunication of the Remonstranten

who do not claim to know the ultimate truth and are considered a very

tolerant religious society. The remainign Protestants came op with a

dictated confession of faith. These days Dutch society still reflects

such traits.

Some

Dutch asset managers are 100% exclusionist

and do not allow even marginal non-sustainable activities in

investment prospects, whilst others accept minor non sustainable

activities up to 5%. For instance sustainable asset managers Triodos

and ASN Bank are 100% exlusionists, but Double Dividend accepts 5%

turnover from certain

non sustainable activities 32.

I

think the impact indicator would allow an investment product in for

instance level 5 if a corporation is active in the field of ESG-opportunities, even if it is still small as long as it has a sincere

intention to upscale these activities in the future. Planned

marketing budgets would be a nice indicator, but are unfortunately as

confidential as Research & Development budget. Sincere

intentions should be supported by commitments, impact policies and

transparent reporting on Key Performance Indicator progress and

alterations. That should build enough trust as opposed to impact

washing

claims and window

dressing

of minor activities. Renat Neuberger of the Huffington Post recently

warned for an 'additionality'

check for green bonds to see if a company is really pursuing new

sustainable/impact activities with the funds or mainly marketing it

this way 33.

He

gives a nice checklist. Jed Emerson and Bugg Levine also give a few

examples in their book Impact Investing, Transforming how we make money while making a difference'

34.

A

peaking impact investment universe?

No,

it's a terraced pyramid

Though the impact

indicator leveling suggests a peaking shape, it is actually a

terraced pyramid with steep peak in the middle. There are at present

few(er) opportunities in the higher impact levels, unless corporate

green/social, impact and development bonds keep surging as rapidly as

they do and become more inclusive for retail investors. In impact

investing literature it is often stressed that there is a need

for such innovative financial structures 35.

But usually this

refers guaranteed and

unguaranteed debt and the different risk levels accepted by

development banks and charities taking on the risk.

It seems easier to me

to build investment products with impact for specific activities and

thus bonds emissions than equity, company stocks. That

is until social impact enterprises, ETP's and funds start

entering the stock markets in large numbers.

Opening up the investment market

As the indicator's

level structure implicitly encourages investing in higher

impact investment products, I am positive that corporations and

(impact) investment enterprises will be encouraged to develop impact

bonds. The present surge in the climate or green bond market is very

inspiring and expected to accelerate. Green or Climate Bonds are

often oversubscribed two and threefold 36.

The

addition of green credentials to investment products makes them more

attractive for (institutional) investors 37.

Resulting in relatively cheap(er) abundant capital to be invested in

…. more growth capital for activities with impact. Why

do I expect this? Because Harvard and London BS research has shown

that sustainable and responsible investment opportunities have done

this for sustainable companies. Thus giving them the opportunity to

invest in more and more in sustainability and

maintain there leading role 38.

So

the impact indicator also aims to accelerate the upscaling of impact

investing

through the development of investment products with impact. That

makes the impact investment market attractive for new players. These

aims are identical with the successful French Finansol

label

that aims to build

investors trust in socially responsible investment (SRI) products,

stimulate the introduction of SRI products and stimulate demand for

SRI products 39.

From a marketing point of view I am encouraged that impact investment products will attract new (investors) generations such as the Millennials in the US. They are the generation, born between 1978-2000 that will inherit an unprecedented amount of wealth, estimated at 41trillion US$. They are already earning well, and as Americans plan their own financial retirement. But they value (social) investment power more than their parents, seeing opportunities for private social investing to deal with societal and global shortcomings and are 'natural' impact investors 40.

New and improved

I have argued that an impact indicator for investment products is feasible, as in both possible and practical and that it would give investors an idea of the impact of their investment at a glance. That is reasonably easy to apply because the indicator integrates mainstream systems for Socially Responsible Investment and equity selection criteria on Environment, Social and Governance (ESG) policies. The state of affairs in which responsible investing means 'doing less harm'.

But the impact

indicator also looks at investment selection strategies that aim at

solutions for peoples basic needs and catalytic fields working on

global challenges. The ambition of responsible investing to 'do

good'.

This

it is also a marketing tool for corporations and developers of

(impact) investment products. But not only that it is an effective

instrument to attract abundant en cheap(er) capital for activities

with (more) impact.

Implementation

For the implementation

the recently developed Climate Bonds Initiative model of

standardization and external verification can be incorporated. And

(big) banks agree on Impact Bond Principles as they did for the Green

Bond Principles. Both important steps with market accelerating

effect. The Green Bond market is expected to grow with 150% to

100billion US$ in 2015.

Impact

accelerator

Last but not least the

impact indicator could be and do much more than the 'kitemarking

label' for social impact investments the G7 Social Investment

Taskforce just appealed for. It accelerates high impact investment

products through it's pyramid structure. The higher impact levels

clearly show the importance of impact investing for

individuals and society at large.

2

Report

Impact

Investment: The Invisible Heart of Markets—Harnessing the

power of entrepreneurship, innovation and capital for public good

(pdf,

31 pages, recommendations

on page 43, or page 25 in the pdf.)

3

High

Sustainability companies significantly outperform their counterparts

by 4.8% per annum over the long term” In The

impact of corporate sustainability on organization process and

performance

by Eccles, Ioannou en Serafeim, Harvard Business School, Nov11)

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1964011

(pdf,

57 pages) and 'Corporate Social Responsibility and Access to

Finance' (2011)

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1847085

4

High

Sustainability companies significantly outperform their counterparts

by 4.8% per annum over the long term” In The

impact of corporate sustainability on organization process and

performance

by Eccles, Ioannou en Serafeim, Harvard Business School, Nov11)

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1964011

(pdf,

57 pages) and 'Corporate Social Responsibility and Access to

Finance' (2011)

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1847085

5

'Socially

Responsible Equity'

by McKinsey Consultant Alex Hamilton Chan (former MIT) in the

Stanford Social Innovation Review The

responsible hand overcoming

the shortcomings of impact investing.

Dutch Review in

IINieuws-15maart12

(Academia).

6

From Ideas to Practice, Pilots to Strategy. Practical Solutions and

Actionable Insights on How to Do Impact Investing.

Industry Agenda December 2013 A report by the World Economic Forum

Investors Industries. Chapter 4.3 Incorporating Impact Criteria in

Portfolio Construction: From Policy to Implementation page 26.

http://www3.weforum.org/docs/WEF_II_SolutionsInsights_ImpactInvesting_Report_2013.pdf

9

In Dutch

webpage http://www.vfi.nl/standpunten/vermogensbeheer

and guidelines:

http://www.vfi.nl/cms/streambin.aspx?requestid=9C86DA82-9A3B-42CA-B9C8-B25481230FCE

(pdf, 5 pages)

11

NAB France

http://www.socialimpactinvestment.org/reports/Investissements-a-impact-social.pdf

(pdf, 141 pages recommendation on page 35-36)

14

http://www.climatebonds.net/2014/05/new-climate-bonds-hsbc-report-reveals-25-growth-issuance-climate-themed-bonds-over-past

Key

Findings

Climatebonds/bonds-climate-change-2014

Presentation:

http://www.climatebonds.net/files/files/HSBC%20report%202014%20London%20launch%20v2.pdf(pdf,

24 sheets) Report:

http://www.climatebonds.net/files/files/CB-HSBC-15July2014

(pdf,

12 pages) Summary

in Dutch

(F&F)

http://impactinvestingnews.blogspot.com/2014_09_01_archive.html

15

More on:

http://www.vbdo.nl/en

16

Frank is doing

PhD research on

Socially Responsible Investment. Specifically on the influence of

shareholders on the social and environmental policies of public

companies. At Wageningen

University

17

It used to be 90% in Europe till 2013, but the recent

Eurosif Report on SRI

in Europe 2014

(October 2014 and actually 13 countries) states a guestimate 41% of

assets under management in Europe is guided by exclusion strategies.

This is mainly caused my the prohibition by law of Cluster Munition

and Anti Personnel land mines investments in a number of Western

European countries.

http://www.eurosif.org/our-work/research/sri/european-sri-study-2014/

19 More

on Sharia investing on:

http://www.emergingmarketsesg.net/esg/2013/09/02/five-questions-about-islamic-finance-special-interview-with-usman-hayat-cfa-director-islamic-finance-esg-cfa-institute-london-united-kingdom-september-2-2013/

23

Climatebonds.net/new-climate-bonds-hsbc-report-reveals-25-growth-issuance-climate-themed-bonds-over-past

Key

Findings

Climatebonds/bonds-climate-change-2014

Presentation

summary (pdf, 24 sheets) Climatebonds/HSBCreport

launch

Report:

Climatebonds/HSBC-15July2014

(pdf, 12 pages)

25

In

the Goodreads summary it states:

''how

to improve their present organization while simultaneously creating

its replacement''.

26

Ownership Capital is a ''new' asset manager and partly a break away

from the ESG team of one of the big Dutch institutional investors

PGGM. Alex van der Velden COO summarizes their focus as looking for

''sound

business strategies focussing on innovation that are executed in a

sustainable, well-governed manner''

in

http://www.sri-connect.com/index.php?option=com_content&view=article&id=761:meet--otto-van-buul-principal-ownership-capital&catid=120:meet&Itemid=1271

27

McKinsey.com/insights/redefining_capitalism?

The original article is in

Capitalism

Redefined

in

Democracy: A Journal of Ideas, Issue 31, winter 2014.

Democracyjournal.org/31/capitalism-redefined

31

Priming

the pump

article series in the Stanford

Social Innovation Review

website.

Theme: Priming

the Pump for Impact Investing

5 columns: Sectors

not just firms,

the

Full Investment Continuum,

Gaps

in the Impact Investing Capital Curve

and Do

No Harm: Subsidies and Impact Investing.

32

http://www.doubledividend.nl/wp-content/uploads/2014/07/DDEF-Veel-gestelde-vragen-juli-2014.pdf

Triodos Bank a Dutch sustainable bank just blacklisted Google for

it's (delivery) drone investment in Boston

Dynamics.

As drone technology is also used for military purposes Triodos Bank

has deleted them form their investible universe which by the way is

100% transparant and online available

http://blueandgreentomorrow.com/2014/07/17/triodos-bank-divests-from-google-over-arms-link/

Investment universe:

http://www.triodos.com/en/investment-management/socially-responsible-investment/sustainable-investment-universe/recent-results/ Another super sustainable Dutch bank also publishes it's Funds holdings online, it is ASN Bank http://www.asnbank.nl/particulier/wat-doen-wij/hoe-vullen-we-duurzaamheid-in/beleggingsfondsen/universum-asn-duurzaam-aandelenfonds.html Courtesy of Piet Sprengers

34(7

sept. 2011, Wiley ed., 306p.) Samenvatting in:

http://impactinvestingnews.blogspot.com/p/gelezen-bronnen-2013-2010.html

of

http://impactinvestingnews.blogspot.com/2011_10_01_archive.html

35

This

appeal also refers to guarantees by development finance institutes

and trust funds. The Global Impact Investing Network (GIIN)

published Catalytic

First Loss Capital

http://www.thegiin.org/binary-data/RESOURCE/download_file/000/000/552-1.pdf

(pdf, 36 pages)

36

Check out the www.Climatebonds.net

(e-newsletter) for recent emissions, coupons and other details.

37 Officially not

just for instutional investors, but at present the market mainly

offers investment product from on average 100.000 US$, so hardly

retail investment products.

38

The Impact of Corporate Social Responsibility on Investment

Recommendations Ioannis

Ioannou

London

Business School en

George

Serafeim,

Harvard

Business School (March 2013)

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1507874

(pdf, 34 pages) and 'Corporate

Social Responsibility and Access to Finance' (2011)

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1847085

39…G8

Social Investment Taskforce

final

report recommends a kitemark label inspired by the French label

Finansol. In the NAB France report

Investissement a impact social, page

35-36. “Le Label Finansol répond à ce triple

objectif: - Développer la confiance des investisseurs dans

les placements solidaires... Favoriser le développement d’une

gamme élargie de produits d’épargne solidaire

...

Faire progresser le niveau d’exigence des produits d’épargne

solidaire afin qu’ils répondent pleinement aux attentes

des investisseurs ainsi qu’aux besoins de financement des

entreprises solidaires.

40 Read Jed Emerson, and Linsday Norcott's The Millennials Perpective, Understanding Preferences of the New Assets Owners. An ImpactAssets Issue Brief on critical issues in Impact Investing. http://www.impactassets.org/files/ImpactAssets_Issue_Brief_13_Millennial_Perspective.pdf

Geen opmerkingen:

Een reactie posten