Beleggingsanalisten

gebruiken het begrip Moat -Engels voor de (soms) met water gevulde

slotgracht om een vesting- om de vooruitzichten van een

belegging/bedrijf te beschrijven ten opzichte van concurrenten.

De

term wordt o.a. gebruikt door rater Morningstar dat eer indices mee

bouwt. Moat is gebaseerd op 4(5) kenmerken : switching

costs, network effects, intangible assets, efficient scale (&

competitive & cost advantage). De rating schat de voorsprong op

de concurrentie van narrow

(smal) 0 of 1 jaar tot wide

(brede) moat

tot wel 20 of 10 jaar afhankelijk van de sector.

Het

bepalen van moat is een 'uitdaging' bij bijv. diversified largecaps

door het opereren op meerdere markten en in de hele wereld, laat

staan voor transformerende ondernemingen & snel opkomende,

veranderende sectoren.

Met

transformerend bedoel ik bedrijven die de Klimaat

& Impact transitie als strategie voor de

onderneming/sector omarmen en zich heruitvinden als Impact

Growth Stock. Het begint

met kosten-besparende activiteiten zoals het terugdringen van

negatieve impact door te besparen op grondstoffen, energie &

watergebruik, afval & etc.

Het evolueert naar nog steeds

kostenbesparende activiteiten met positieve impact in het

Safety&Health & personeelsmanagement

en door nieuwe diensten & producten met (meer) impact te

ontwikkelen. Dat

kan ook als

de traditionele, oorspronkelijke kernactiviteiten geen Basisbehoeften

of Impact Tech zijn. #DSM & #Philips.

MOAT:

Kwantiteit, score op UN SDG Goals?

Het

ligt voor de hand om de Impact

Moat = breed te bestempelen als veel

impact indicatoren worden beoogd & gemeten,

bijv. de 17(2

criteria)

Global Sustainable Development Goals van de VN voor

alle mensen, landen en ondernemingen: interne en onderlinge doelen.

Dat

kan voor (Sociale) ondernemingen en beleggingsproducten. De meeste

kijken ondernemingen en SDG/Global Impact indices meestal naar kern-

& operationele ESG activiteiten en kiezen dan een (focus) of

enkele SDGs. Moederindices met usual suspects. Bijv iShares

Global Impact en

Swells Impact 400.

VIGEO

EIRIS doet het iets ruimer voor de Wereldbank:

https://www.slideshare.net/alcanne/vigeo-eiros-sdg-thema-per-company

MOAT:

Kwaliteit, de diepte in bij een SDG

Een

andere praktijk van impact moat bepaling is bijv. Equality

& Diversity

indices/indexfondsen die kijken naar het aantal Vrouwen

in de Board

(1) & het Management

(2)

& (vastgelegd) beleid

(ambitie

& monitoring, 3).

ETFdbase heeft ESG data van MSCI en hanteert

voor de ESG score voor

ETFs op Board

Diversity: No

Female Directors, Three or More Female Directors & Females

Represent 30% of Director. https://etfdb.com/esg-investing/governance-issues/board-diversity/

Een

bredere moat voor bedrijven en indices is bijv. gebouwd op veel meer

relevante data, zoals de Nederlandse Equileap

index familie van vrouwvriendelijke bedrijven op basis van analyse

van

3000 bedrijven in 23 landen en

19

criteria.

A:

Gender Balance in Leadership and Workforce:

› Non-executive board › Executives › Senior management ›

Workforce › Promotion & career development opportunities;

B:

Equal Compensation and Work/Life Balance:

›

Fair remuneration › Equal pay › Parental leave › Flexible work

Options;

C:

Policies Promoting Gender Equality:

›

Training & career development › Recruitment strategy ›

Freedom from violence, abuse, & sexual harassment › Safety at

work › Human rights › Social supply chain › Supplier diversity

› Employee protection; &

D:

Commitment to Women’s Empowerment:

›

Gender Audit.

Meer

op https://equileap.org

Beide

MOAT interpretaties focusen op de bedrijfsvoering

& impact

Investing focust primair op kernactiviteiten

& dan bedrijfsvoering.

ESG

inspanningen van largecaps hebben door hun omvang grote 'do

less harm'' & ''do good'' impact binnen

de onderneming, de productieketen, maar

ook in de sectoren en landen waar zijn actief zijn als katalysator.

Elke

onderneming & investering moet bijdragen aan economische

groei: omzet & winst en werkgelegenheid.

De ontwikkelingsfase waarin een economie en/of sector zich bevindt is

doorslaggevend. De NL ontwikkelings-bank FMO investeert in projecten

die werkgelegenheid (1e impact metric).

Ondernemingen

in ontwikkelde markten (moeten) investeren in tech-nologische

ontwikkelingen zoals automatisering = minder zwaar & monotoon

werk + IRD, Refurbishing & Circulair Ondernemen.

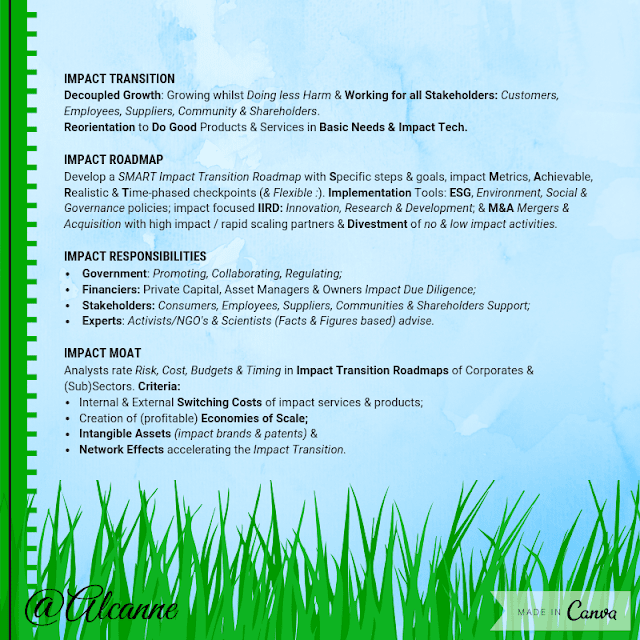

IMPACT

MOAT: Kosten & Tijdspad

van de Transitie naar Impact (Growth)

Stock

Inspanningen voor Innovatie, Research & Development i.e. technologische vooruitgang die niet bijdragen aan (lange termijn) kostenbesparing & concurrentievoordeel zoals ESG inspanningen maar ook niet aan basisbehoeften & impact technologie zijn niet meer toereikend voor de evolutie naar Nieuw Kapitalisme.

Ondernemingen & Investeerders zullen moeten focusen op Societal Solutions, producten & diensten aanbieden voor basisbehoeften & de impact tech die basisbehoeften voor zoveel mogelijk mensen bereikbaar & betaalbaar maken.

Idealiter weten we precies welke technologische vooruitgang de meeste maatschappelijke (positieve) impact zal hebben. Al doende leert men. Het internet begon als defensie project, werd omarmd door de wetenschap voor kennisuitwisseling, vervolgens decades gedomineerd door pornosurfers voordat het miljarden mensen toegang gaf tot essentiële informatie & grootschalig werkgelegenheid & economische groei creëerde.

Omdat niemand in de toekomst kan kijken is Impact focused Governance de voor de hand liggende keuze van ondernemingen & sectoren. Zij hebben inzicht in de impact van hun diensten & producten & productiewijze & hun (netto) toegevoegde waarde voor de samenleving (economische groei, werkgelegenheid, belastingafdracht).

Ondernemingen & Sectoren hebben inzicht in de kansen van Innovatie, Research & Development en hoe deze bijdragen (aan economische groei, werkgelegenheid, belastingafdracht) en maatschappelijke impact. Concurrentie (voordeel) focust op voorzien in Basisbehoeften & (betaalbare) toegang door Impact Technologie.

Ondernemingen & Sectoren kunnen kosten & budgetten vaststellen & het tijdpad bepalen van hun transitie, de interne & externe switching costs naar impact diensten & producten, het creëren van de benodigde schaal, winstgevende economies of scale door hun intangible assets (impact brands & patents) en network effects die de impact transitie versnellen.

Klinkt bekend?

Het zijn Morningstar moat definitie kenmerken, maar gericht op de transitie naar impact concurrentie.

''The measure of the competitive barrier, if any, that gives a company an advantage over its rivals and allows it to generate above-average returns on invested capital. Four major types of economic moats are: high customer switching costs; economies of scale: intangible assets such as brands or patents & the Network Effect”. https://www.morningstar.com/InvGlossary/economic_moat.aspx

Het network effect, concurrentie treed op tussen ondernemingen (leaders & laggards) “the value of a company's service increases for both new and existing users as more people use the service” maar vooral tussen sectoren.

Alle moat elementen worden versterkt & verrneld door regulering & internationaal overheidsingrijpen & desinvesteringen, de uitstroom van investeringskapitaal.

Beinhockcer

& Hanna

https://www.mckinsey.com/featured-insights/long-term-capitalism/redefining-capitalism

Idealiter weten we precies welke technologische vooruitgang de meeste maatschappelijke (positieve) impact zal hebben. Al doende leert men. Het internet begon als defensie project, werd omarmd door de wetenschap voor kennisuitwisseling, vervolgens decades gedomineerd door pornosurfers voordat het miljarden mensen toegang gaf tot essentiële informatie & grootschalig werkgelegenheid & economische groei creëerde.

Omdat niemand in de toekomst kan kijken is Impact focused Governance de voor de hand liggende keuze van ondernemingen & sectoren. Zij hebben inzicht in de impact van hun diensten & producten & productiewijze & hun (netto) toegevoegde waarde voor de samenleving (economische groei, werkgelegenheid, belastingafdracht).

Ondernemingen & Sectoren kunnen kosten & budgetten vaststellen & het tijdpad bepalen van hun transitie, de interne & externe switching costs naar impact diensten & producten, het creëren van de benodigde schaal, winstgevende economies of scale door hun intangible assets (impact brands & patents) en network effects die de impact transitie versnellen.

Het zijn Morningstar moat definitie kenmerken, maar gericht op de transitie naar impact concurrentie.

''The measure of the competitive barrier, if any, that gives a company an advantage over its rivals and allows it to generate above-average returns on invested capital. Four major types of economic moats are: high customer switching costs; economies of scale: intangible assets such as brands or patents & the Network Effect”. https://www.morningstar.com/InvGlossary/economic_moat.aspx

Denk bv aan de sectoren die Colombia Threadneedle deselecteert in haar Social Bonds Fund of Eccles & Consolandi op basis van bijdrage aan de SDG's zoals finance (!, but we can fix that with impact financing AJH).

HIGH RISK:

● Aerospace/Defense ● Air Transportation ● Auto Loans ● Auto Parts & Equipment ● Automakers ● Energy – Exploration & Production ● Foreign Sovereign (if general use of proceeds for central gov) ● Gaming ● Government Guaranteed (if general use of proceeds for central gov) ● Integrated Energy ● Metals/Mining Excluding Steel ● Oil Refining & Marketing ● Oil Field Equipment & Services ● Steel Producers/Products ● Tobacco.

NB Tabak heeft niet toevallig de laagste SDG bijdrage in Eccles/Consolandi rating systeem.

MINIMAL or UNUSUAL SOCIAL BENEFIT:

● Advertising ● Beverage ● Brokerage ● Cable & Satellite TV ● Insurance Brokerage ● Investments & Misc Financial Services (concullega's) ● Packaging ● Media Content ● Media – Diversified ● Machinery ● Monoline Insurance

● Multi-Line Insurance ● Recreation & Travel Reinsurance ● Software/Services ● Sovereign ● Tech Hardware & Equipment ● Non-European issuers (excluding international or social bonds).

Bron: Colombia Threadneedle Social Bonds Fund Guide 2018. SOCIAL INVESTMENT GUIDELINES THREADNEEDLE EUROPEAN SOCIAL BOND FUND Uitsluiting High Social Risk voetnoot 7, p.20. Meer over EXCLUSIE 2.0 SECTOREN in mijn eBook ImpactInvesting NL:

https://image.slidesharecdn.com/ebookimpactinvestingnl7jaarinvesterenmetimpact-181220185225/95/ebook-impact-investing-nl-7-jaar-investeren-met-impact-alcanne-35-638.jpg?cb=1545332555

Sectoral Contrubition to United Nations Sustainable Development Goals Prof Bob Eccles & Dr Constanza Consolandi in MIT Sloan Review https://image.slidesharecdn.com/ebookimpactinvestingnl7jaarinvesterenmetimpact-181220185225/95/ebook-impact-investing-nl-7-jaar-investeren-met-impact-alcanne-42-638.jpg?cb=1545332555 https://image.slidesharecdn.com/ebookimpactinvestingnl7jaarinvesterenmetimpact-181220185225/95/ebook-impact-investing-nl-7-jaar-investeren-met-impact-alcanne-43-638.jpg?cb=1545332555