PART I : http://impactinvestingnews.blogspot.com/2019/08/public-equity-impact-investing-theories.html looked at overlapping area's & agenda's in ESG: Environment, Social & Governance management & IRD: Innovation, Research & Development activities & Impact Investing. ESG is a top down, investment/regulation dominated holistic universe where as IRD is bottom up practice & market (opportunitie & threats) based.

INVESTEE OPTIONS:

The rapidly growing ESG universe is largecap, financials dominated and open to new entries & impact potential perspectives. Analysts, Institutional Investors & Investment product overlook impact & impact growth potential undermining companies low cost access to finance opportunities for non ESG champions.

(But) ESG and overlapping IRD activities make corporations impact investment prospects as both deal with cost & -negative impact- reduction, cheaper -less harm- alternative resources & efficient production.

1st CLEAN HOUSE

Exclusion & Negative Screening: Controversies & Issues

&

2nd GET WITH IT

Dialogue & Engagement Agenda's & Awareness, Regulation

INVESTOR RELATIONS:

Shortcuts & Catalysts:

Using ESG Frameworks (theme's, metrics, indices, funds)

& Sector Expertise: IRD focus & competition

to attract investors

Asset Management Strategies & Mandates primarily define risk appropriate return goals for Investors.

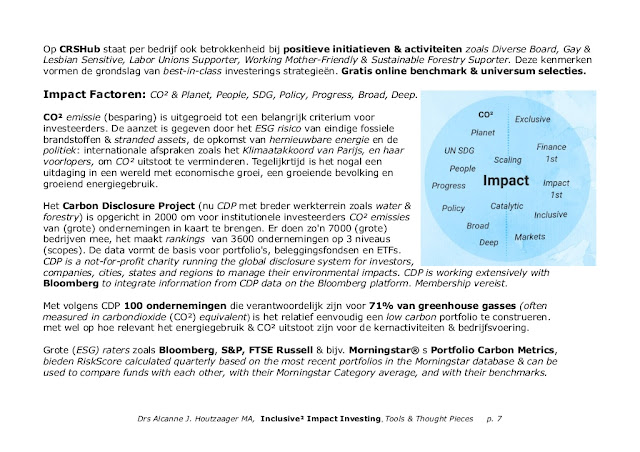

Theories of Change are strategies for (impact) investors to define how to achieve impact: societal & environmental goals with risk appropriate returns.

Ethical (exclusion), ideological or sustainability motivations improve investors understanding of impact dilemma's & choices, synergies & conflicts.

In PART II I will sketch impact investment choices based on actual market offerings & trends such as ESG Risk & Opportunities Integration, Best in Class selection and PEOPLE INVESTMENT in Food, health, Housing (property!) & finance (inclusive & mesofinace).

Corporations i.e. Capitalism choosing Impact Growth Strategies: focus ESG & IRD investments towards DECOUPLING negative impact of economic growth& focus on impact services & products. Attractive investments.

Their IMPACT MOAT (long term economic perspective) is WIDE as successful companies will be the multinationals of the future providing economic growth/innovation, employment & socialtal solutions: impact services & products.

THORIES of CHANGE in IMPACT INVESTING

PART 1 & 2: